Receivables Credit Memo

Content

Creating a credit memo manually was tedious work that consume a lot of time and effort. But all thanks to InvoiceOwl which allows creating credit memos in just a few seconds, so businesses can save time and focus on other areas of the business. Without giving it a second thought, start your FREE trial with us and explore all the features and functionalities of the software. Panel UI, such documents are actually assigned to the reseller transactions that correspond to order items in a customer’s order. String The service view usage name, an internal name for the service data object. Specify the value of the element from the getEntityList operation response payload. A canceled subscription continues to bill because the subscription cancel date is after the next scheduled bill run.

- Let our capable team of accountants take over the bookkeeping tasks for your business today.

- One common reason is the buyer returns a purchased item to the seller.

- So you must issue a Credit Memo document which has a total amount of $40.

- Moreover, in some industries, it is also known as a credit note.

- Emilie is a Certified Accountant and Banker with Master’s in Business and 15 years of experience in finance and accounting from corporates, financial services firms – and fast growing start-ups.

The date and time when the service definition last changed in ISO 8601 format. The document created to partially or fully reverse an original invoice. And here, I select the existing sales order, press okay, and it will populate the line with the info from the sales order. From my actions, functions, I will select copy documents to use the original order as an application. Log in to create a playlist or see your existing playlists. When a buyer receives an order that is incomplete, incorrect, damaged, or erroneously invoiced, the seller may need to cancel the invoice–partially or in full.

Tax on a Credit Memo

Therefore Cindy sends a credit memo form to Toys N’ More informing them that they should reduce the amount that they owe to Fluffy Stuffs. Fluffy Stuffs will also reduce its accounts receivable by the same amount. A credit memo is often issued when a seller has made some sort of mistake, or extenuating circumstances have been brought to light which require an adjustment towards a sale. When the latter occurs the bank will transfer the collection of funds into the depositor’s account. Credit and debit memos provide a detailed justification of the amount stated on the memo. You can use the memos to adjust invoices at a line item level and provide your customers with memo documents to track billing changes.

We retain the right to increase or decrease your Credit Line at any time. Any increase or reduction in the amount of your Credit Line will be shown on your monthly statement or by separate notice together with any changes in the applicable Minimum Monthly Payments. Your eligibility for this Credit Line is determined by our loan policy and may be terminated at our sole discretion, without demand or notice. You may close your Credit Line at any time by notifying us in writing and returning all Cards cut in half. Mr. Edward bought some clothes from Clothing Suppliers, LLC. The company’s return policy is that they will accept returns within 15 business days after the purchase is made. Returns will be reimbursed in the form of store credit only. Now, let’s assume that for the billing schedule BS1, a direct credit memo of $65 was created and for the billing schedule BS2, a direct credit memo of $80 was created.

createUnapplyOnAccountCreditMemo

The document can be issued under a cash payment-based method or any other payment method. Moreover, in some industries, it is also known as a credit note. A credit memo, also known as a credit memorandum, is a document issued by the buyer to the seller and is different from an invoice. It is issued to reduce the amount that buyer owed to the seller under the forms of earlier invoice sales.

They are also issued if some products were returned for warranty purposes; and, sometimes, they are used to give the client a previously-negotiated discount or to correct any mistake on the invoice. A credit memo is a shortened term of a credit memorandum, which is a document issued by the seller of goods and services to the buyers. It reduces payments that the buyer owes or the customer owes to the seller after the invoice is sent. A credit memo contains several pieces of important information. Most credit memos feature the purchase order number, as well as the terms of payment and billing. The shipping address, a list of items, prices, quantities, and the date of purchase are other significant pieces of data found on a credit memo. All of this information helps a seller to keep track of inventory.

Ad hoc charges or credits

Credit memos must be compliant with any and all relevant tax requirements. GuideInvoicing Guide Know anything and everything about invoices and invoicing process. Free ToolsInvoice Generator Easy-to-use generate invoices through this free tool. Blog Access to a library of articles products, features, and benefits. Get Paid FasterInvoice Create and send invoices like never before. Reports Get to know financial health and performance of your business.

Costco’s Return Policy Has One Big Catch, A Former Member Reveals – SheFinds

Costco’s Return Policy Has One Big Catch, A Former Member Reveals.

Posted: Mon, 28 Nov 2022 14:00:21 GMT [source]

A new https://www.bookstime.com/ can be issued for a delta with the details above. Views invoices and related documents and takes action, such as approving and resolving holds. String Operation to be performed on the records of a credit memo. String Operation to be performed on the credit memo records. Method is used to find an existing credit memo in Receivables. Revenue reversal rule used for the credit memo to reverse the revenue on the invoice.

Owners of small- to medium-sized businesses get orders from customers, send out invoices, receive payments, and deal with correspondence from vendors. In short, business owners have a wide variety of accounting matters that demand their time and attention. That’s where expert accountants at Ignite Spot comes in. We have experience handling many types of bookkeeping tasks for small business owners. Our online services include assistance with accounts payable and receivable as well as credit card management, payroll, and more. Our firm of accountants can even help business owners at tax time.

Due to billing mistakes, service interruptions, or confusion about invoices, a customer might contact you to contest a charge on the invoice. In such cases, you might need to issue a credit or debit memo to resolve the dispute.

What is A Credit Memo? [Definition + How to Prepare Credit Memorandum]

Refund a certain amount of the credit memo balance to your customer. The purpose of these memos is to adjust specific items in a given invoice. In this case, the memo refers to a specific invoice; the memo items refer to corresponding invoice items. Payments Get your accounts credited faster with online payments. Borrower’s obligation to repay advances under the Line of Credit shall be evidenced by a promissory note dated as of May 1, 2012 (“Line of Credit Note”), all terms of which are incorporated herein by this reference. Promotions.In case of promotions there may be a need to decrease a subscription’s price.

What is an example of a credit memo?

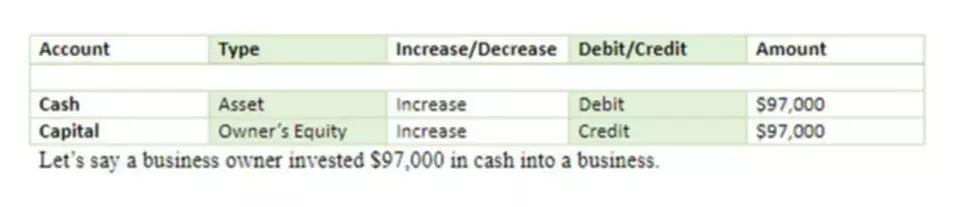

Example of a Credit Memo

The credit memo will result in the following entry in SellerCorp's accounting records: 1) a debit of $8 to Sales Returns and Allowances, and 2) a credit of $8 to Accounts Receivable. In other words, the credit memo reduced SellerCorp's net sales and its accounts receivable.

Posted in: Bookkeeping

Leave a Comment (0) →