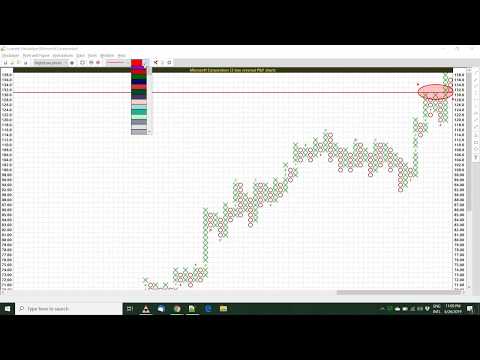

TSM Stock Price TSMC Chart TradingView India

Contents:

The semiconductor industry is poised for significant growth in 2021 and beyond, post its recovery from a cyclical downturn. The content of this article has been created and published by Winvesta India Technologies Pvt. The information and/or content (collectively “Information”) provided herein is general information sourced through various news reports and does not constitute a research report or a research analysis.

We’re Pruning Shares of One Stock, While Adding to Two Others – TheStreet

We’re Pruning Shares of One Stock, While Adding to Two Others.

Posted: Mon, 10 Apr 2023 15:37:00 GMT [source]

To make the Companys performance more resilient, the Company is focussing on both operational and structural cost improvement initiatives. Several initiatives like Aspire, Shikhar 25 have led Tata Steel to operate at global / Indian benchmark levels on multiple KPIs. Cost leadership can be achieved through execution of structural cost reduction initiatives such as investments in augmenting the raw material portfolio to meet increasing demand, strengthening logistics networks and fixed cost reduction among others. It intends to drive break through improvement projects with focus on safety, environment, people standards and in collaboration with internal/external stakeholders to achieve best in class operational performance. Policies like Vehicle scrappage policy and Steel Scrap Recycling Policy are likely to give an impetus to this sector.

China trade slump, Apple woes, central bank meetings – what’s moving markets

We remain vigilant of the evolving market conditions and its impact on steel-intensive sectors. There was increase in cold rolled and coated market share across key OEMs and ancillaries. In our endeavor to enhance footprint in India, we have built a diversified portfolio of product offerings for customers from a range of industries to leverage the growing opportunities in these segments. Upside risks could emanate from stronger and sustained expansion in domestic demand. Domestic demand is expected to be led by the governments thrust on capital expenditure, healthier corporate balance sheets leading to private investments and re-start of contact intensive services.

After redevelopment, de-notification of slums by State/UT Government is recommended under the guidelines. All houses under PMAY have basic amenities like toilet, water supply, electricity and kitchen. The Mission promotes women empowerment by providing the ownership of houses in name of female member or in joint name. Preference is also given to differently abled persons, senior citizens, SCs, STs, OBCs, Minority, single women, transgender and other weaker & vulnerable sections of the society. A PMAY house ensures dignified living along with sense of security and pride of ownership to the beneficiaries. Technology is being utilised to track compliance, timelines with suitable escalations, action plans and reviews.

U.S. stocks are falling after retail sales fuel rate fears

An erosion of trust with communities will slow down societal impact and lead to consequent loss of reputation or business continuity for us. Tata Steel has institutionalized business continuity management through development of tactical center for response to any major onsite emergency and developed CoE in Process Safety Management to deploy standardized process safety management across the organization. Workplace Safety & Process Safety Management in Tata Steel have matured over the years through adoption of various robotic and technological solutions.

To ensure better socio-economic development of the people in the peripheral areas of its operations, TSK focussed on Health, Education, Infrastructure Development, Livelihoods, skill upgradation and Women Empowerment among others. • Tata Steels strategic engagement and relationship management with Raw Material suppliers has led to efficient inventory control thereby managing/avoiding any adverse effect due to major global events such as Indonesias ban on coal exports. In second half of 2021, persistent tight availability of spot cargoes from major miners led Ex-China buyers to contend for material.

U.S.-listed shares of Taiwan Semiconductor Manufacturing Co fell 5.3 per cent after Warren Buffett’s Berkshire Hathaway Inc (BRKa.N) slashed its stake in the chipmaker. We create rich business content, reach targeted business audiences, and provide valuable business information to our readers. Taiwan Semiconductor’s valuations are inexpensive, and there are multiple re-rating catalysts for TSM. The average analyst rating for Taiwan Semiconductor is 4.3, with ratings of 1 and 5 referring to Strong Sell and Strong Buy ratings, respectively. The consensus sell-side target price for TSM is $105.81, which translates into a +22% upside as compared to its last traded price of $86.80 as of January 16, 2023.

The processing and sales yard at Marine Drive, Jamshedpur has been augmented with new facilities for further value enhancement of by-products. Through horizontal deployment of best operational practices, steam-based steel slag weathering facility has been erected at TSK plant and is under commissioning stage. Post-amalgamation the annual production capacity increased from 612 k tonnes to 1,034 k tonnes. The Khopoli unit has a Large Dia Tube plant, designed to serve the high-end Oil & Gas (O&G), water pipelines and infrastructure segments.

The little-known company behind TSMC’s most advanced semiconductors

At the start of this financial year, we had set a target of achieving investment grade level financial metrics and we were able to achieve the same within 6 months of this financial year. The Company is also exposed to currency volatility given the import requirements, foreign currency debt and offshore operations. Multiple initiatives for skill building of employees were undertaken during the year.

- “Sentiment actually remains intact as top players of the industry tend to accelerate their investment to distance themselves from rivals,” the 66-year-old executive said.

- In order to keep up with the production growth strategy, Tata Steel is developing its own port- Subarnarekha Port Private Limited to de-risk the import supply chain.

- TSE was marginally higher mainly on accounl of fresh additions during the year partly offset by adverse exchange impact on translation along with depreciation and amortisation charge during the year.

- Just write the bank account number and sign-in the application form to authorise your bank to make payment in case of allotment.

We are continuously working to integrate Hydrogen gas in ironmaking processes as a non-fossil fuel and reductant. We are discussing on the possible ways of Hydrogen generation and injection into Blast Furnace thereby becoming one of the worlds first in this field. During the year under review, Tata Steel has successfully tried injection of Coal Bed Methane in one of the Blast Furnaces and able to reduce carbon intensity by replacing metallurgical coke.

STOCK SUMMARY

This year, we focused on diversification of exports in terms of geographies and products . As the restrictions eased out and domestic demand improved, domestic deliveries were increased. A real-time digital dashboard was also put up during the COVID-19 second wave for monitoring and updates of the risks arising out of the resurgence of the pandemic and mitigations were pursued accordingly.

what is upi and Korea have long been the epicenters of chipmaking — TSMC leads the way with cutting-edge logic processors like Apple Inc.’s bespoke Silicon parts while Samsung and SK Hynix Inc. dominate the memory market — which has led to increasing discomfort in the US and Europe. After the bell, Roku (ROKU.O) surged 14 per cent following a revenue forecast that beat analysts’ expectations. Across the U.S. stock market (.AD.US), advancing stocks outnumbered falling ones by a 1.4-to-one ratio. In terms of valuations, Taiwan Semiconductor’s consensus forward fiscal 2024 P/E of approximately 12.5 times as of January 16, 2023 is rather undemanding for a company with an impressive track record of consistently delivering high ROEs .

Strategies For Successfully Launching A Startup In A Competitive Market

Although the https://1investing.in/ supply chain is complex, it provides opportunities for value maximisation through global optima, the need for which is more apparent and obvious with operations getting multi-site and multi-locational. Thus, to bring an integrated approach and achieve global optima, « One Supply Chain division » was formed. One Supply Chain works in synergy with various divisions with an overall focus on enhancement of supply chain performance for all sites. Digitalisation and Optimization are the key levers being used to enhance visualisation and bring about integration. This is helping Tata Steel to take proactive decisions, keeping system view in mind and achieving integrated margin management. Tata Steel continues to work towards diversification in sourcing and expansion of the vendor base to manage the supply chain disruptions.

Shipping charges applicable may vary depending on your pincode and the quantity purchased. Shipping charge is the amount collected from customers to partly cover the courier expense incurred in delivering an order. The elevated spending on semiconductor hardware is positive information for chip-gear creators like , Applied Materials , and Lam Research . Taiwan Semi procured $1.15 per U.S. share in the December quarter, up 19% from the year-sooner period. The IFSC code of a bank can be commonly found on a bank account passbook, cheque leaf issued by the bank or on the RBI website. The LHPs are being implemented in Gujarat, Jharkhand, Madhya Pradesh, Tamil Nadu, Tripura and Uttar Pradesh to demonstrate the innovative construction technologies which are cost-effective, green and sustainable.

- Monitor the latest movements within the Taiwan Semiconductor Manufacturing real time stock price chart below.

- Marginal decrease at SEA was mainly due to divestment of Singapore operations at NSH in Q2 FY 2022, partly offset by higher bonus provisions at Thailand.

- To achieve this, the company is preparing itself to be future ready by ensuring safety at all touch points, strengthening its supply & service base, building vendor partnership, focussing on standardization and strengthening its in-house capability for equipment manufacturing.

- As highlighted in its Q financial results presentation, the company’s revenue declined by -1.5% QoQ to $19.9 billion in the final quarter of the previous year.

- The outflow during the current year broadly represents repayment of borrowings including finance lease Rs.1,033 crore, along with payment of interest Rs.2,868 crore, payment of dividend Rs.3,007 crore, repayment of Hybrid Perpetual Securities Rs.775 crore.

• In by-products, few campaigns to make the departments free from plastic and E-waste were successfully launched and driven to generate revenue for the company. The Company is committed to being aligned with Indias nationally determined contribution and the European Unions commitment on Climate Change. It also has taken note and working towards steps discussed in COP26 by Prime minister of India. Tata Steel is focused on its path for net neutrality in Tata Steel Europe by 2050 and committed to 2/tcs for Tata Steel India by 2030. To achieve the target, Tata Steel is making a range of efforts across the organisation for GHG emission reduction activities that include increasing efficiency of operations, use of more recycling scraps, carbon capture, utilization, storage , and hydrogen-based steelmaking. • Group synergies through centralized procurement, technical optimization and knowledge sharing continued to result in substantial savings and efficiency improvement.

Posted in: Forex Trading

Leave a Comment (0) →